LSEG Workspace for analysts and portfolio managers

Helping analysts and portfolio managers to outperform and be more productive – from idea generation and opportunity analysis to ESG risk management and portfolio monitoring.

LSEG and Dow Jones announce a multi-year data, news and analytics partnership

LSEG Workspace for analysts and portfolio managers

Helping analysts and portfolio managers to outperform and be more productive – from idea generation and opportunity analysis to ESG risk management and portfolio monitoring.

LSEG and Dow Jones announce a multi-year data, news and analytics partnership

Develop a non-consensus view more quickly

In competing for AUM it is necessary to identify new ideas, execute on strategies that outperform and manage risk in the portfolio. And now integrating ESG data into the investment management process is critical to winning mandates and improving investment outcomes.

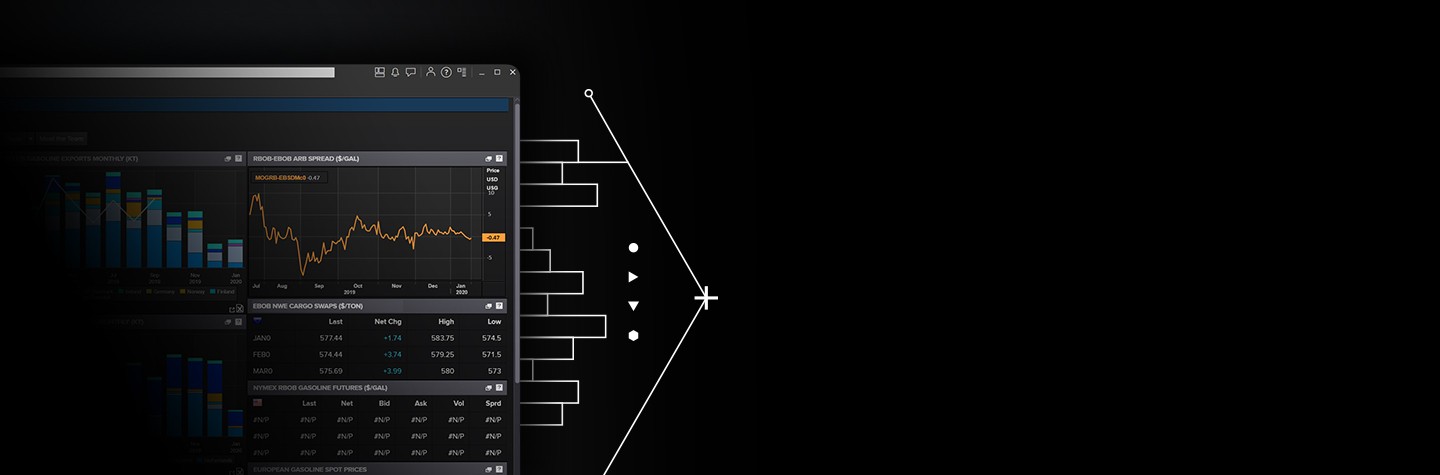

Designed specifically for investment workflows, LSEG Workspace for analysts and portfolio managers saves you hours every week with a combination of intelligent content discovery, unique analytics and unrivalled content.

LSEG provides industry leading data – from company fundamentals and estimates to industry and macro data, Reuters News, StarMine analytics and ESG metrics.

Why LSEG Workspace?

Improve productivity at every step

Always available. Wherever you are.

Bringing together macro and company data, differentiated analytics and screeners to quickly identify and assess ideas.

The world’s leading managers use our integrated ESG data to systematically build sustainability into their investment process – mitigating risks and improving returns using company and sovereign sustainable investment data.

Analyse multi-asset class portfolios including cross-asset attribution, contribution, performance and style analysis.

Features & benefits

What you get with LSEG Workspace for analysts and portfolio managers

Outperform with insights that drive new investment ideas

- Analyse I/B/E/S aggregate broker estimates and valuation multiples across indices, countries, sectors and industries to uncover where the sell-side analyst community expects to see growth.

- Quickly surface insights and ideas for companies positioned to take advantage of macro trends with keyword and conceptual searches across news, transcripts, filings and research.

- Save precious time with SentiMine natural language processing, sentiment analysis and deep learning to provide insights from transcripts.

Leverage a wide range of factors including StarMine analytics to rapidly narrow down and identify interesting stocks from your investable universe.

Pinpoint sources of performance and identify risk exposures

- Portfolio Analytics provide a comprehensive understanding of portfolio performance and risk for multi-asset class portfolios including market leading RiskMetrics and Barra Optimizer from MSCI.

- Deconstruct a company’s ESG score to manage risk and improve investment outcomes with over 630 data points and 70 analytics, backed by auditability all the way to the source documents – covering 80% of global market cap.

Stress test portfolios to assess the potential impact of historical or custom scenarios.

Quickly identify credit opportunities and accurately assess default risk

- Workspace makes it easier to undertake due diligence of the company’s ability to generate cashflow and pay down debt as well as identify risks that could result in default.

- Build up a comprehensive view of business quality starting with fundamental data with 40+ years of historical coverage through to analysts estimates and StarMine credit models.

- Take advantage of Yield Book’s fixed income analytics with the single security calculator integrated into Workspace.

Assess the impact of economic indicators on your investment strategy using Datastream in Workspace.

LSEG AlphaDesk

Request product details

Speak to a specialist

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576