LSEG Workspace for corporate treasury

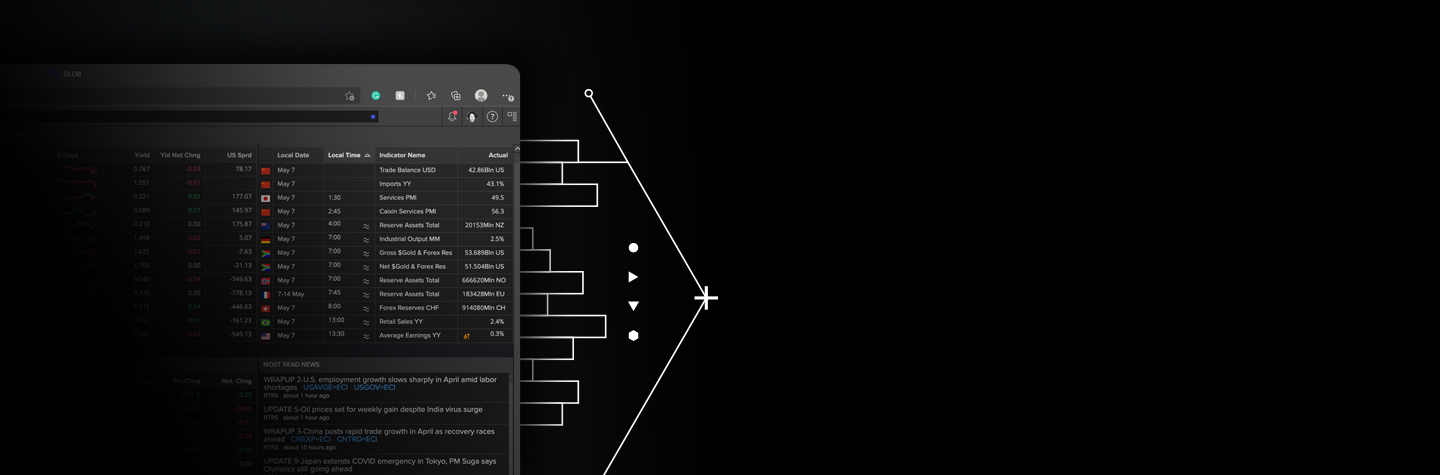

Discover a cutting-edge workflow solution designed for corporate treasury professionals that equips you with the information and analytics you need to effectively manage financial assets.

You can access LSEG Workspace from any device, giving you the flexibility to act quickly while being aligned with your strategic goals.

Advancing with a unique and customised workflow solution

Discover how Workspace offers extensive pre-trade analytics, news, pricing and other expert insight to help inform your investment and hedging strategies.

Choose your preferred device to experience Workspace’s next-generation workflow that can be seamlessly integrated into your existing workflows and treasury management system (TMS). You can access cross-asset data, risk monitoring and price discovery, funding and investment analysis, market leading transaction platforms for hedge execution and valuations as well as ESG content and analytics.

Work flexibly from anywhere at any time as Workspace automatically syncs across your desktop, web and mobile, thanks to its cutting-edge web technology that’s fast and light.

Drive stability with global coverage

Always available, wherever you are.

Leveraging our partners’ capabilities, Workspace delivers an end-to-end treasury workflow including cashflow, liquidity and risk management as well as supply chain finance. Treasurers have a dedicated landing page that gives easy access to essential capabilities organised by treasury role.

Explore how StarMine Credit Risk models predict credit deterioration ahead of the credit ratings agencies, Reuters FX Polls inform FX hedging strategies and FX Volume Heatmap identifies when best to trade given historical liquidity and volume patterns.

Combine Workspace’s pre-trade data, news and analytics with the electronic capabilities of our award-winning FXall platform for executing FX trades.

Make better-informed decisions using in-app insights derived from exclusive LSEG content, including our FX trading platform pricing and pricing curves from TradeWeb. Get exclusive access to Reuters News, plus 10,000 other sources in multiple languages, and real-time broker research from 1,300 sources.

Evaluate positions for pre-trade and post-trade scenarios and choose from analytics critical for corporate treasury (FX forwards/interest rate swaps/FX options) now hosted and computed in the cloud for enhanced performance.

Workspace is part of an open-technology ecosystem that we are building to support your end-to-end workflows. Compatible with FDC3 interoperability protocols, Workspace simplifies cross-referencing data and connecting with proprietary systems, enabling integration to your current TMS, ERP and transaction platforms.

Features & Benefits

What you get with LSEG Workspace for corporate treasury

A highly customisable solution, built for you

Your homepage is tailored for your workflow, and with Workspace’s web-based design, you can effortlessly navigate between key apps in a browser-like window.

Access comprehensive information and valuable insights on market monitoring, funding, investments, liquidity, risk management, hedging, and ESG with the ‘CORPT’ app.

Full suite of pre-trade, cross-asset market monitoring and analysis apps and tools

Identify how changes in money market rates will impact credit facility borrowing and interest income, monitor consumer confidence, spending and credit levels, view balance sheets and credit risks of your suppliers, clients and peers.

The Currency Performance Value Tracker (FXPT) allows you to monitor multiple value metrics across multiple currency pairs. You can also evaluate heat maps, performance rankings and outlier plots.

Reliable access to liquidity to execute your hedging strategy

Optimise short-term liquidity versus long-term borrowing with access to the widest range of information and insights.

Liquidity Heatmap shows how liquid the market is for a given 30-minute window compared to all previous 30-minute time slices in the lookback period.

Request product details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576