LSEG Workspace for fixed income

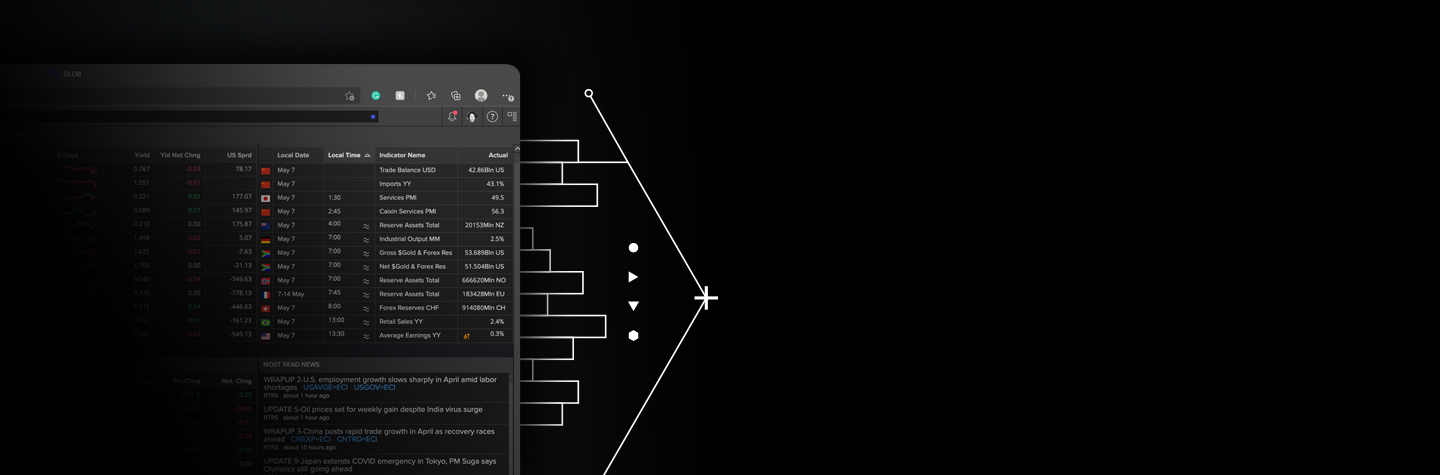

Experience a powerful next-generation workflow tool that equips you with the information and analytics you need to succeed across the full fixed income value chain – across pre-trade and liquidity discovery, to trade execution, post-trade and capital optimisation.

Benefit from high-performing, smarter technology and a streamlined user interface – all customisable to your preferred workflow experience. Know first, so you can act first – in the office or while on the go.

Advancing with a unique and customised workflow solution

Get unparalleled access to consolidated pricing data and insights with Workspace, designed for the future of fixed income.

As a highly customisable solution, Workspace gives you the knowledge, speed and flexibility you need to monitor market activity, manage risk and make informed decisions.

Workspace is also interoperable – meaning you can effortlessly integrate insights into your fixed income workflows – helping you advance in today’s rapidly changing financial landscape.

A tailored solution

Always available, wherever you are.

Access award-winning Reuters News, combined with 10,000 other authoritative sources in multiple languages, and real-time broker research available from 1,300 sources. Reuters Polls and Rates Probability analytics help you to predict central bank rates.

Access pricing for over 2.7 million fixed income securities on daily and intraday bases from LSEG Evaluated Pricing Service. Streaming data from Tradeweb, MarketAxess and Markit CDS. Explore insights from IFR Markets, the leading source of fixed income, capital markets and investment banking news and commentary.

You can use powerful and comprehensive rates, credit and structured products analytics calculators to analyse deal- and portfolio-level trade ideas at the deal and portfolio level using LSEG and Yield Book analytics. StarMine Credit Risk Models help you predict credit deterioration ahead of the credit ratings agencies.

Choose from coverage of swaps, swaptions, caps and floors coverage from TPICAP, Tradition, BGC Fenics and others, plus curve content from swap zeros, futures zeros, credit curves to issuers curves.

Build highly customised fixed income tools using LSEG APIs: retrieve/build zero curves, swaption vol surfaces and use market-leading analytics APIs to price any fixed income products from vanilla to complex instruments based on Yield Book, Adfin and Pricing Partners’ analytics libraries.

Workspace adapts to your workflow, with seamless access to the apps and tools most relevant to you. With intelligent search powered by structured and natural language capabilities, you’ll get to the data and insights you need with fewer clicks.

Features & Benefits

What you get with LSEG Workspace for fixed income

A powerful selection of fixed income analytics and calculators

Perform in-depth price and Yield Analysis on a bond, including future cash flows and sensitivity analysis with Fixed Rate Bond Calculator (FRB).

StarMine Credit Risk Models

Access proprietary models to predict credit deterioration ahead of the credit ratings agencies.

The StarMine Combined Credit Risk Model (CCR) combines information from the StarMine Structural, SmartRatios, and Text Mining Credit Risk Models into one final estimate of corporate credit risk.

LSEG Evaluated Pricing Service

Discover evaluated pricing for over 2.7 million fixed income securities on daily and intraday bases.

Our coverage spans all major financial markets. Prices are available at multiple times daily – including for Hard-to-Value assets.

Request product details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576