LSEG announces the launch of turn impact-adjusted FX forward curves on LSEG Workspace.

This capability enables seamless FX workflows across our key customer communities of:

- Sales & Trading (FX sales, FX traders, middle and back-office)

- Buy-side (FX asset owners and managers, middle and back-office),

- Corporates (treasury)

In the world of foreign exchange trading, transparency in forward FX pricing remains a significant challenge. Buy-side traders often encounter discrepancies between calculator rates and those quoted by their liquidity providers, especially when outside of standard tenor dates (1M, 3M, 6M). This lack of alignment is primarily driven by two key market events:

- Demand-Driven Funding Squeezes: At the end of the month, quarter, or year, corporate funding requirements surge, resulting in increased demand and a liquidity squeeze. This phenomenon is evidenced by a spike in forward-forward rates.

- Central Bank Monetary Policy Implementation

Standard calculators often overlook these complexities, instead relying on simple interpolation of standard tenor dates. Yet notably, 20% of all RFQ trades on FXall occur on these special dates.

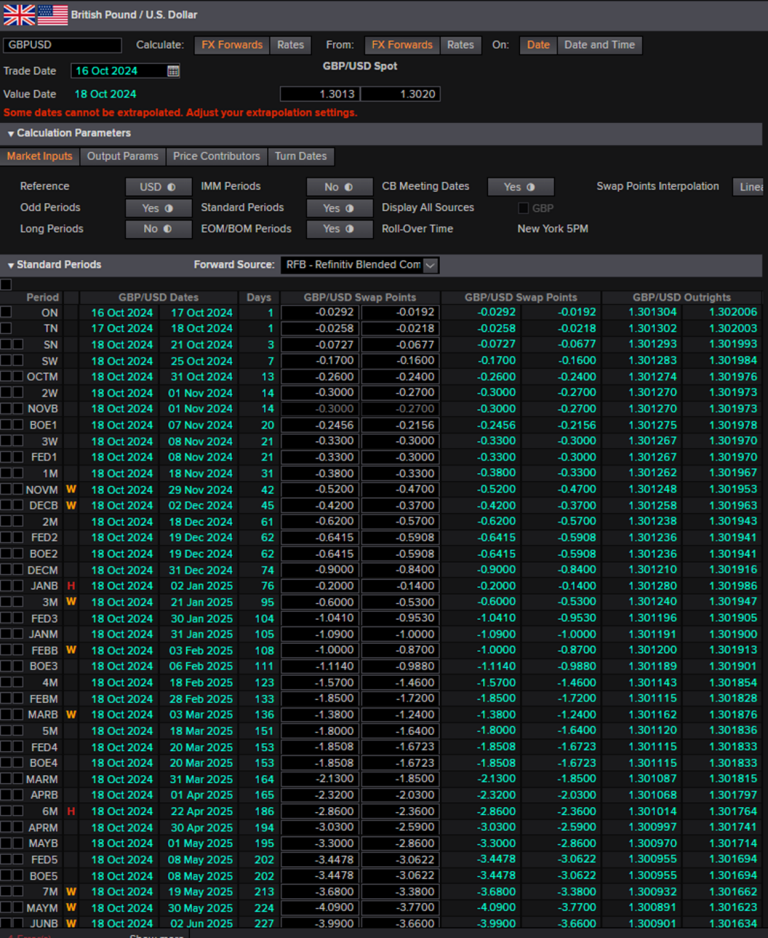

In collaboration with partner banks, LSEG has developed FX Turn Impact-adjusted FX Forwards curves. Leveraging our cloud-based Adfin analytics, these curves provide a comprehensive forward FX term structure, complementing monthly tenors with these special turn dates. This is crucial in today’s volatile short-term interest rate environment.

The curves are available in the Workspace Curve Builder (CURVB) or in the FX forward calculator (FWDS) empowering Traders at Corporates, Asset Managers, Hegde Funds or liquidity consuming Banks, before they hedge their risk on FXall or Advanced Dealing.

They are also available as Data Feeds which empower Market Makers looking for systematic price discovery or pricing clients over their FX e-trading channels.

LSEG’s Group Head of FX Sell-side Trading, Bart Joris, said: “The key to success in trading is having the right data at the right moment. In a stressed market, transparency matters for returns. Having visibility on the forward curve enables participants to improve trading accuracy, enhance price discovery, and manage mark-to-market and credit risk more effectively. This leads to a more robust and inclusive FX trading community.”

Request product details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576