Our take on Solvency II

Solvency II laid out a fresh set of regulatory requirements for European insurance firms. Its core aim is to harmonise capital requirements and risk management standards for the insurance industry.

The Solvency II framework has three areas, often referred to as pillars:

- Pillar 1 sets out quantitative requirements – these include rules to value assets and liabilities, to calculate capital requirements and to identify eligible proprietary funds to cover those requirements.

- Pillar 2 sets out requirements – for risk management and internal governance, as well as the details of the supervisory process with competent authorities.

- Pillar 3 addresses transparency – reporting to supervisory authorities and disclosure to the public, enhancing market discipline and increasing comparability, leading to more competition.

We can help you meet Pillar 1 and Pillar 3 obligations under the regulation. And we provide you with the necessary data needed to assess your capital adequacy.

From January 1, 2020, insurance regulator EIOPA began to use LSEG as its source for risk-free rate (RFR) term structures. Actuaries at insurance companies can gain a four-day timeliness advantage by taking the underlying data directly from us, rather than waiting for the official publication by the regulator.

How it works

Three key stages to our Solvency II solution

-

1

-

2

-

3

Features & benefits

Why partner with LSEG for Solvency II

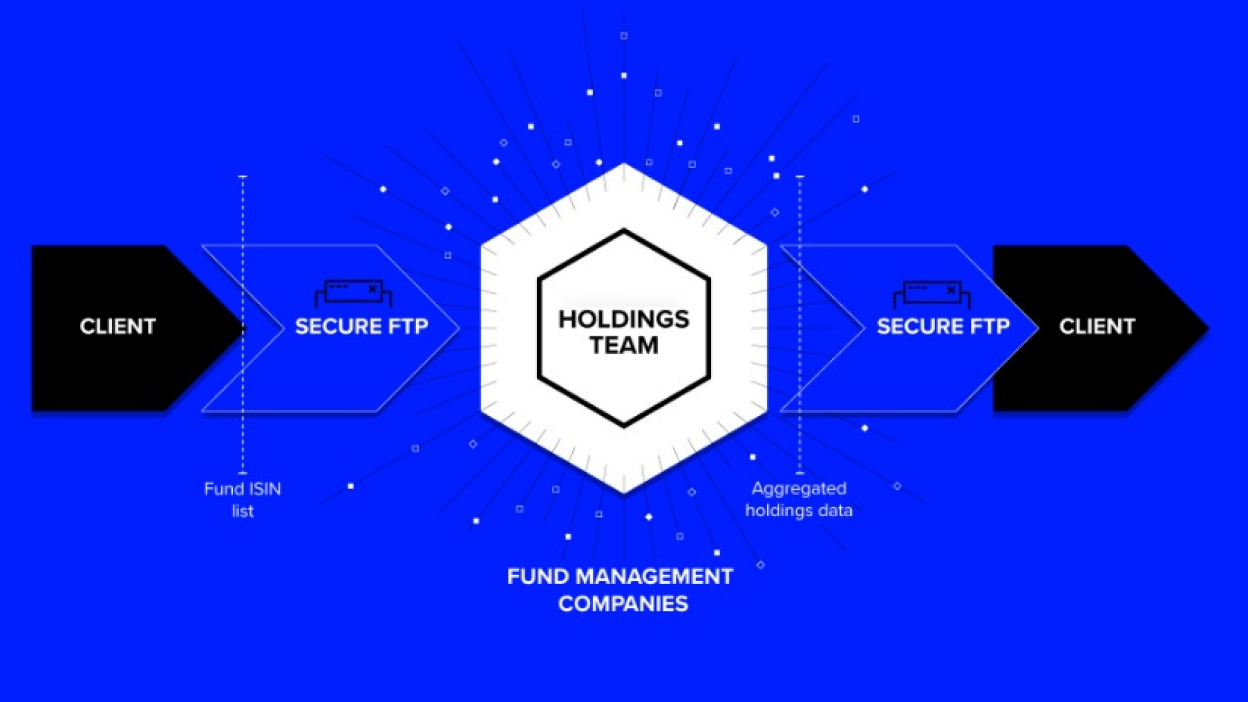

Also known as fund look-through data, provided in a consolidated feed (subject to non-disclosure agreements with fund management companies). This ensures that accurate fund constituents are sourced and aggregated for subscribers, maximising their ability to meet regulatory reporting timelines.

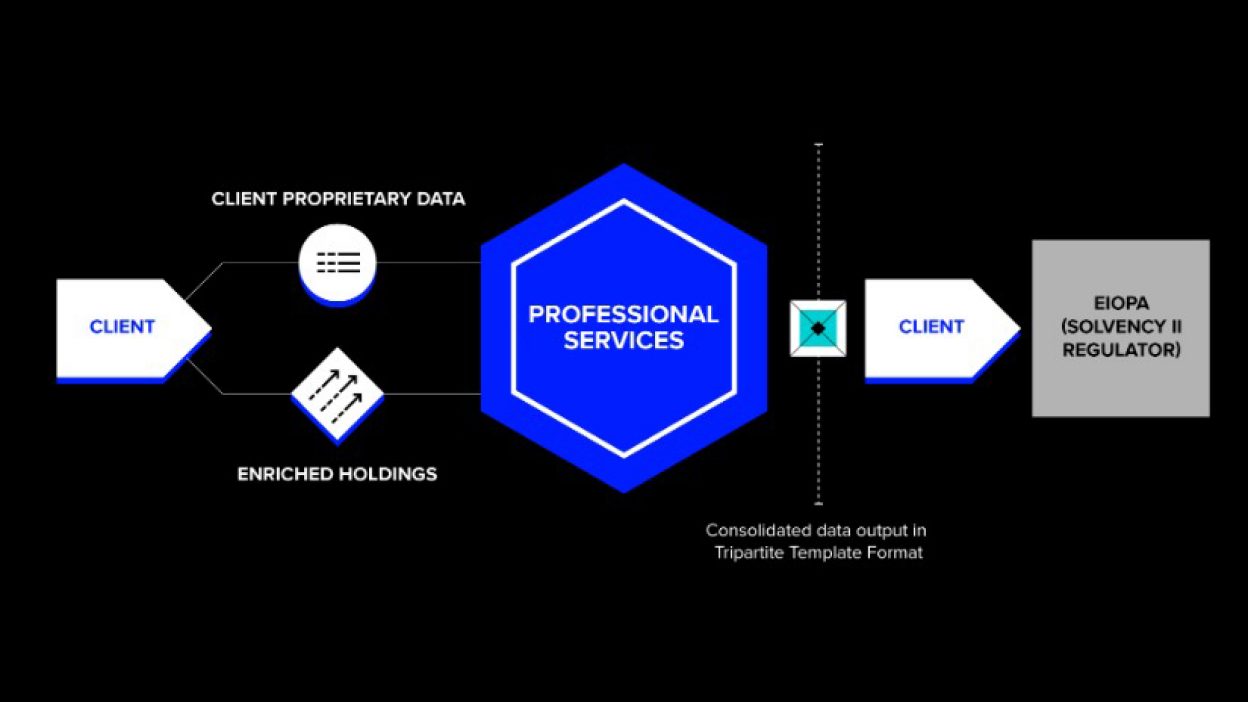

LSEG Professional Services offers an extract, transform and load (ETL) software service. It’s a service which can combine full holdings data with pricing and reference. It also holds a client’s own proprietary data to populate the Tri-Partite Template for an insurer’s quarterly regulatory reporting obligation to the European Insurance and Occupational Pensions Authority or EIOPA.

An extensive library of pricing and reference data, including a full complement of attributes needed for TPT/Tri-Partite Template submission such as CIC, LEI and Ratings. Our evaluated pricing team covers less liquid and hard-to-price assets, meaning the additional capital requirements usually required from insurers when asset valuations are not available may be mitigated against.

Request details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576