Grace Ong

As we enter 2025, global economic volatility is impacting various sectors. Geopolitical tensions, monetary policy shifts, and supply chain disruptions are creating both challenges and opportunities for Corporates. This insight will explore key factors contributing to this volatility and key steps Corporates can take to mitigate them.

- Geopolitical tensions, monetary policy shifts, and supply chain disruptions are creating challenges and opportunities for businesses in 2025. Corporates must navigate these complexities to manage global operations and capital flows effectively.

- The unpredictable relationship between interest rates and currency values adds complexity to financial decisions. Corporates need to manage FX risks carefully, using hedging strategies to protect against currency market swings and maintain profit margins.

- Corporates should review hedging policies, optimise treasury management structures, enhance cash flow forecasting, and assess counterparty risks. Effective risk management and strategic resilience are crucial for navigating the changing economic landscape.

As we move through the first quarter of 2025, volatility continues to shape the global economic landscape, with implications for Corporates in various sectors. The interplay between geopolitical tensions, monetary policy shifts, and supply chain disruptions has created both challenges and opportunities for businesses managing global operations and capital flows.

While market fluctuations can seem like a constant, recent trends have added new layers of complexity in the interest rates and foreign exchange markets. In this blog we will explore some of the reasons for this volatility and its effect, including Geopolitics and Economics, Rate Decisions and Currency Impact, Corporate Strategies and the role of Trade Finance and Supply Chains.

Geopolitics and economics: Growing impact of global tensions

A shifting geopolitical landscape, especially with the U.S. on tariffs and trade, are causing uncertainty. Countries are focusing on trade barriers for countermeasures and using monetary policies to manage economic stability, avoiding business disruptions.

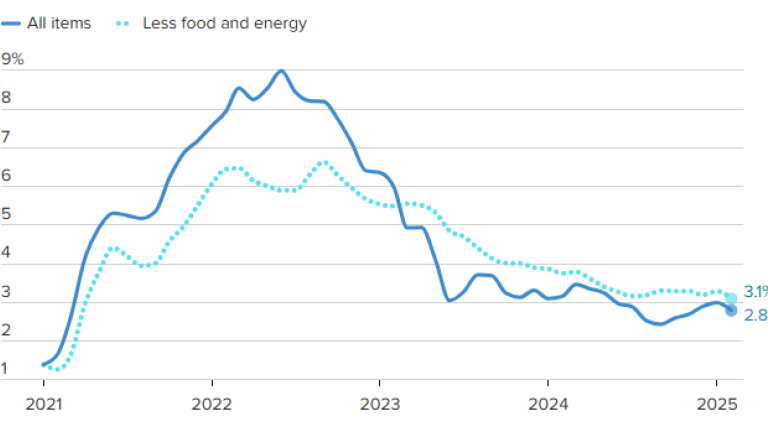

Recent U.S. inflation data is giving mixed signals: the Consumer Price Index (CPI) rose by 3.1% in February, and the Producer Price Index (PPI) rose by 3.4% annually, both lower than expected whilst still above the Federal Reserve’s target rate of 2%. The upcoming Personal Consumption Expenditures (PCE) data is expected to follow this trend, likely keeping the Fed from changing interest rates. These factors are creating market uncertainty and volatile trading conditions, particularly for companies with cross-border businesses affected by the U.S. economy.

US consumer price index

Year-over-year %change | Jan. 2021 - Feb. 2025

Note: Not seasonal adjsuted

Source: US Bureau of Labor Statictics. Data as of March 12, 2025. Past performance is no guarantee of future results.

PCE Price Index va Core PCE price index

While some Central Banks (e.g. People's Bank of China and the Bank of England) have held rates decisions steady, a few have begun pivoting toward continuous easing cycles:

- The Reserve Bank of Australia cut its rate by 25 basis points to 4.10% in February, marking its first easing since November 2020

- The European Central Bank’s Governing Council decided in March to lower the three key ECB interest rates by 25 basis points, the sixth reduction since June 2024

- Canada's BoC decreased rates by 175 basis points through 2024, another 25 basis points on 12 March with continued gradual cuts anticipated throughout 2025

Despite perceived inflationary pressures, different monetary policy responses worldwide show concerns about economic growth. This marks a shift from the aggressive tightening seen in 2022-2023.

Rate cuts and currency impact: A double-edged sword for Corporates

The relationship between interest rates and currency values remains unpredictable due to different economic conditions worldwide. Market sentiment, influenced by tech innovations and large cap earnings reports, adds complexity to financial decisions like capital raising and hedging.

Lower interest rates make loans attractive but reduces savings returns, leading to less demand and potential weakening of the currency for economies which have gone into easing measures. For Corporates operating internationally, this can make exports more competitive but increase import costs, affecting profit margins.

Corporates must manage FX risks carefully, as currency fluctuations impact everything from international contracts to raw material costs. Hedging strategies, like cash flow and fair value hedges, are crucial tools for Corporates to protect against capital market swings.

Corporate Treasury imperatives: Proactive risk management

In response to these volatile conditions, Corporates will need to recalibrate across the following strategic priorities:

- Review Hedging Policies: With associated rates volatility, it's crucial to optimize hedging strategies. Companies should assess their FX and fixed income hedging approaches to align with current market conditions. Effective hedging can protect cash flows and financial reporting numbers from fluctuating rates and currencies. Understanding different hedging strategies helps companies choose the best one for their company’s exposure.

- Assess Treasury Management Structures: Corporate treasury departments should review their cash pooling and transfer pricing policies. Optimizing cash pools can reduce transaction costs and improve liquidity across different regions, especially borrowing in low-rate environments. An in-house banking structure can help manage cross-currency exposures effectively.

- Enhanced Cash Flow Forecasting and Scenario Analyses: Volatility makes accurate cash flow projections crucial, especially with currency movements affecting financial results. Corporate treasurers should use strong forecasting methods that consider FX and interest rate variables and conduct scenario analyses to understand the impact of extreme market changes on liquidity and financial covenants.

- Counterparty Risk Management: Rising volatility increases counterparty risk. Corporates should assess the financial health of their vendors and suppliers, and use trade finance facilities to mitigate these risks. As traditional financing becomes riskier, options like supply chain finance can be more cost-effective due to shorter cash conversion cycles.

Trade dynamics and supply chains: Navigating disruption

Interest rate and FX concerns extend beyond capital markets and impact global trade. Corporates must consider how volatile rates affect imports, exports, and supply chains. A stronger domestic currency can reduce exports by making goods more expensive globally, while boosting imports by lowering the cost of foreign goods.

Corporates will need to consider supply chain management challenges by monitoring FX market volatility and be aware of taxes, customs, duties, and tariffs. For example, in Asia-Pacific, supply chain challenges persist due to geopolitical tensions, technology, regulations, and space limitations which disrupt growth opportunities. Finding financing facilities to reduce borrowing costs and maintain liquidity is crucial for Corporates.

Looking ahead: Strategic resilience

As we progress through 2025, Corporates must remain vigilant to evolving market conditions while building flexible risk management frameworks. With rate cuts from major central banks, geopolitical uncertainties, and the broader economic landscape remaining in flux, companies must stay agile and responsive. Reviewing hedging strategies, optimising treasury management, and exploring alternative trade finance solutions will be key to mitigating risks and seizing opportunities in this volatile period.

In the coming months, it continues to be essential for Corporates to stay informed about central bank decisions, geopolitical developments, and emerging trends in global trade. Those who can adapt quickly and manage volatility effectively will be best positioned for long-term success.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2024 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.