Features & benefits

What you get with World-Check One

Our advanced technology requires minimal configuration and seamlessly integrates with existing processes with a single touchpoint, ensuring digital customer onboarding is fast and user optimised.

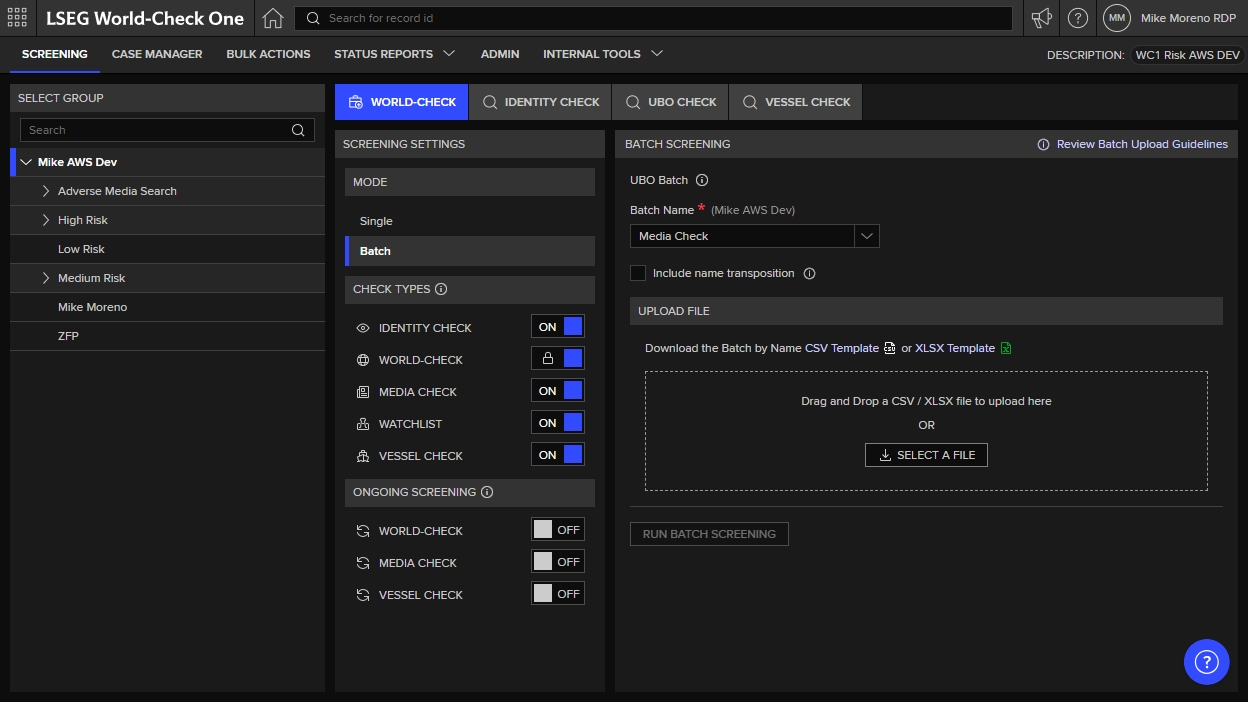

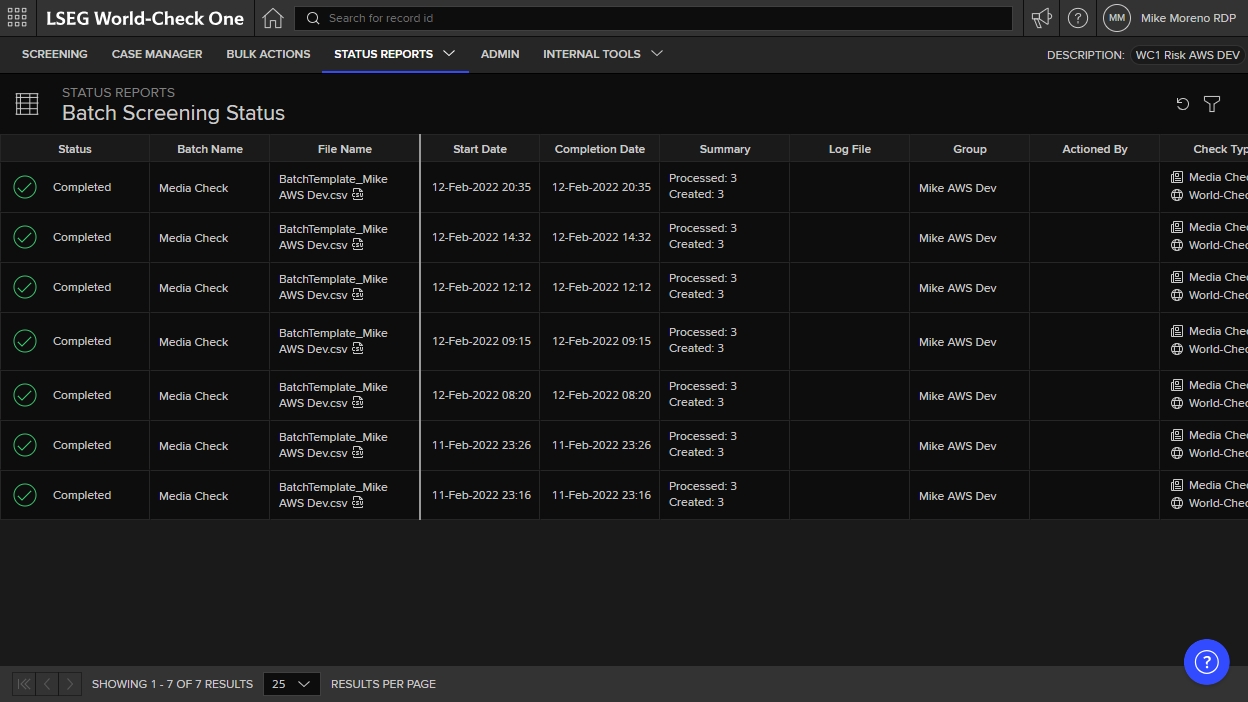

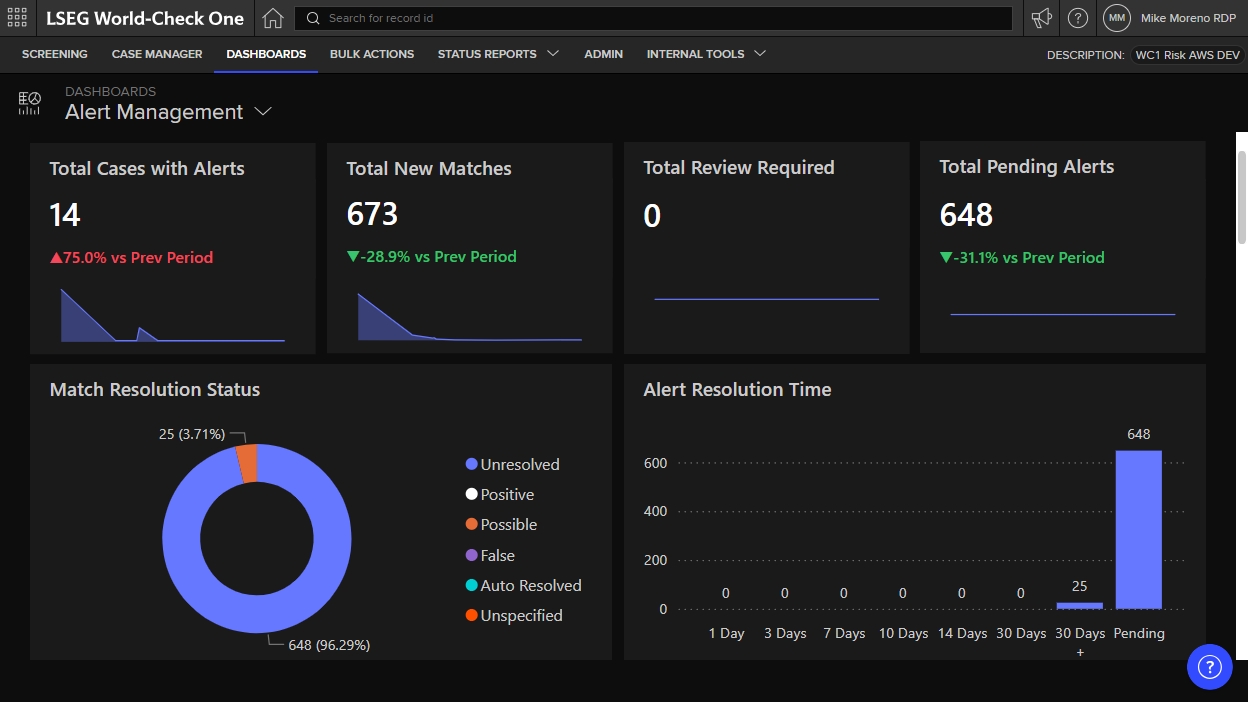

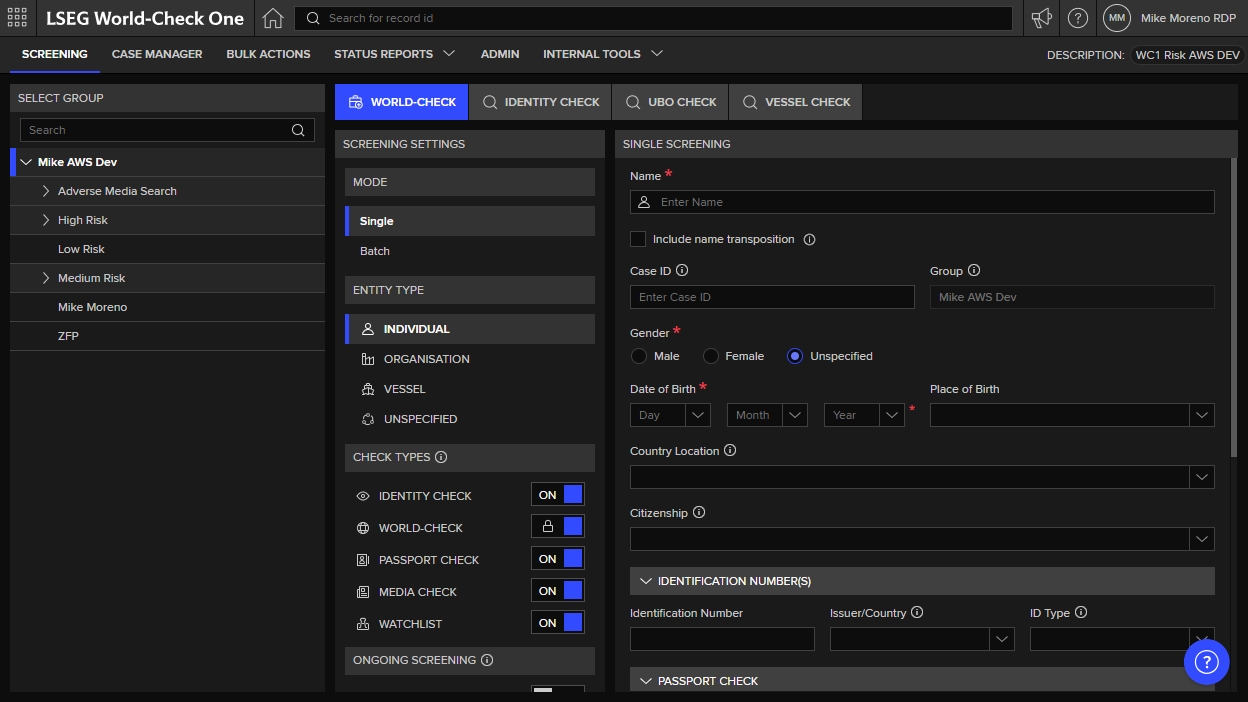

Access screening options, batch screenings, and case management solutions to identify high-risk individuals and PEPs. Ongoing monitoring surfaces insights into emerging AML trends, helping real estate professionals refine risk assessment strategies.

Detect suspicious activities with World-Check One’s real-time data and ensure on-going regulatory compliance for clients. Take a deeper dive through EDD (Enhanced Due Diligence) reports to obtain more details regarding UBO (Ultimate Beneficial Owner), local news media, litigation, regulatory, bankruptcy and more.

Mitigate money laundering risks and enable faster digital onboarding of clients. With World-Check One, seamlessly implement AML/CFT policies, freeing up valuable human and financial resources.

Our packages

Find the perfect fit or tailor your solution. Explore our range of World-Check One packages to meet your unique real estate KYC and due diligence requirements. Should you require assistance with your purchase, please reach out to one of our specialists.

Product in action

See how World-Check One can help real estate firms

Streamlined screening

Streamline processes such as integrating large volumes of information and advanced functionalities into existing workflows and internal systems with our API.

Secondary matching

Reduce false positives to a minimum with multiple secondary identifiers in World-Check, combined with configurable name matching algorithms and filtering technology.

Integrated workflow

Perform Due Diligence check and Ongoing Screening from within your Opportunity or Contact list within Salesforce, escalate high profiles matches to senior analyst, keep track of risk remediation and compliance review all in one place.

Ongoing monitoring

The powerful combination of World-Check One capabilities enables you to simplify screening for money laundering, sanctions and threat finance; monitor PEP relationships and networks; identify third-party risks; configure ongoing monitoring and more.

Is your client’s property funding crime?

The Financial Action Task Force (FATF) estimated that $1.6 trillion were laundered in 2021, which was nearly half the real estate sector’s total worth (around $3.7 trillion)

As real estate is attractive to money launderers, verifying the identity of the ultimate beneficial owner (UBO), assessing the risk profiles of clients and uncovering if funds are legitimate, are an absolute must and can help mitigate business risks.

Potentials risks in the real estate industry include:

- Country/geographic risk: Location of the buyer and seller, location of the property in relation to the buyer

Customer risk: Charities and non-profit organisations not subject to monitoring, PEPs, cash incentive businesses

Transaction risk: Type of property, quick and successive transactions, under or over-valued transactions

Financial risk: Source of funds, cash deposits, loans from unregulated financial institutions

Not adopting a risk-based approach early on can affect real estate professionals

Delaying and blocking transactions that involve sanctioned individuals and entities.

Freezing assets in possession of sanctioned parties.

Heavy penalties when sanctions are breached

Irreversible reputational damage or prison sentence

Simplifying AML checks for estate agents with a risk-based approach

Carry out all necessary real estate due diligence measures to understand the ownership and control structure of any legal entity.

Assess the degree of verification required regarding the beneficial owners depending on the associated ML/TF risks. GUIDANCE FOR A RISK-BASED APPROACH TO THE REAL ESTATE SECTOR | 41 © FATF/OECD 2022

Document the additional procedures to be applied and the measures taken to identify the beneficial owner, as well as the difficulties encountered in establishing identity.

Carry out a thorough search of relevant and available beneficial ownership information, where available to the public, financial institutions, or DNFBPs.

Have a clear and concise policy and relevant training for the basis of a real estate professional or any relevant employee within the business (not limited to the money laundering reporting officer) to lodge a suspicious transaction report when the identity of the beneficial owner has not been satisfied due to a lack of CDD information.

Source: Risk Based Approach Guidance for the Real Estate Sector (fatf-gafi.org)

Frequently Asked Questions (FAQs)

Data File

Integrate World-Check data into third-party or proprietary workflow solutions that perform customer due diligence, customer screening, and/or payments screening.

API

Integrate our data, matching capabilities, and advanced functionalities into existing workflows and internal systems – streamlining the screening process for onboarding, Know Your Customer (KYC), and third-party risk due diligence.

Zero Footprint screening

Benefit from the ability to switch off system tracking, ongoing screening, batch upload, and audit trail functions during screening to ensure no permanent record is kept

Testimonials

What our customers say about us

We partner with LSEG Risk Intelligence to support our market leading compliance program. Integrating World-Check, a respected industry solution in both tradfi and Web3, keeps us at the compliance forefront and positioned for business success.

BitMex

LSEG World-Check’s advanced screening tools help to safeguard our business and ensure a responsible gaming environment for our guests and the community. It's an essential tool that helps us to maintain the highest standards of compliance across our industry.

Crown Resorts

Data and technology are at the core of our services and LSEG World-Check plays a key role in helping our teams to comply with regulation and with our high standards of governance.

CAMS - Computer Age Management Services Ltd

Awards

Check out some of our awards

Chartis Financial Crime and Compliance 50 (FCC50)

Financial Crime Data Management 2024

Partnership Ecosystems 2024

Chartis Research Market Quadrants Report

Name and Transaction Screening Solutions category leader 2024

Adverse Media Monitoring Solutions category leader 2024

RegTech Insight Awards Europe

Best Solution for Sanctions Management 2023

Best Solution for Sanctions Management 2022

Regulation Asia Awards for Excellence

Best PEPs, Sanctions & Name Screening Solution 2023

Best Solutions PEPs, Sanctions & Name Screening 2022

Best AML/CTF Compliance Solution 2019

Best Anti-Money Laundering Solution 2018

RegTech Insight Awards USA

Best KYC Data Solution 2022

Central Banking FinTech RegTech Global Awards

Best Anti-Money Laundering Technology Provider in 2018

Explore more

Relevant products

Request product details

Speak to a specialist

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576