Features & benefits

Streamline compliance: AML and KYC for law firms

Our cutting-edge technology effortlessly integrates with current systems, requiring minimal setup and providing a seamless user experience for fast digital customer onboarding.

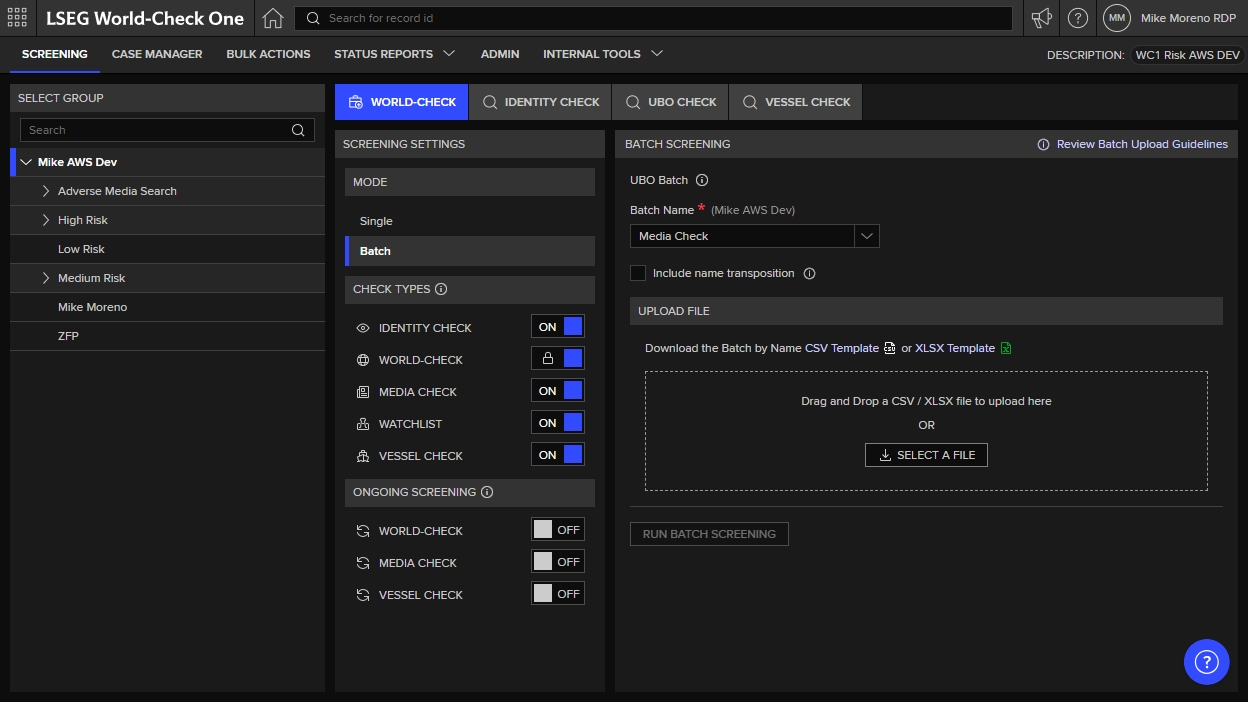

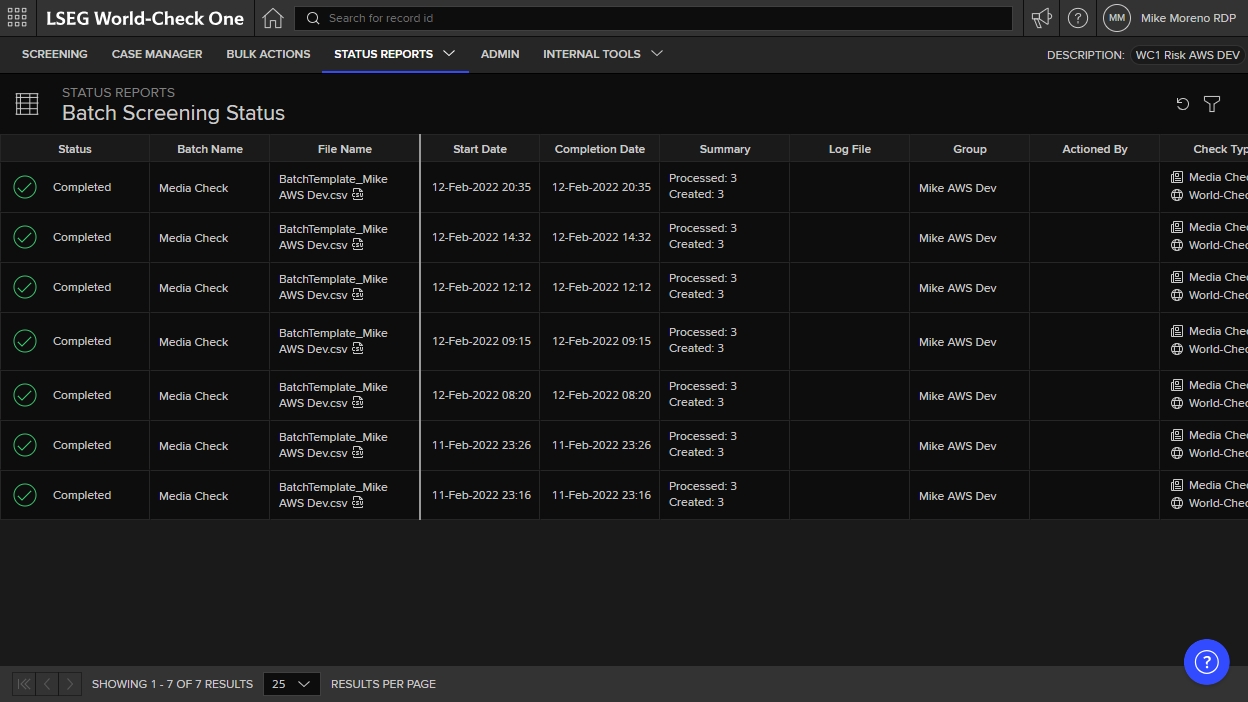

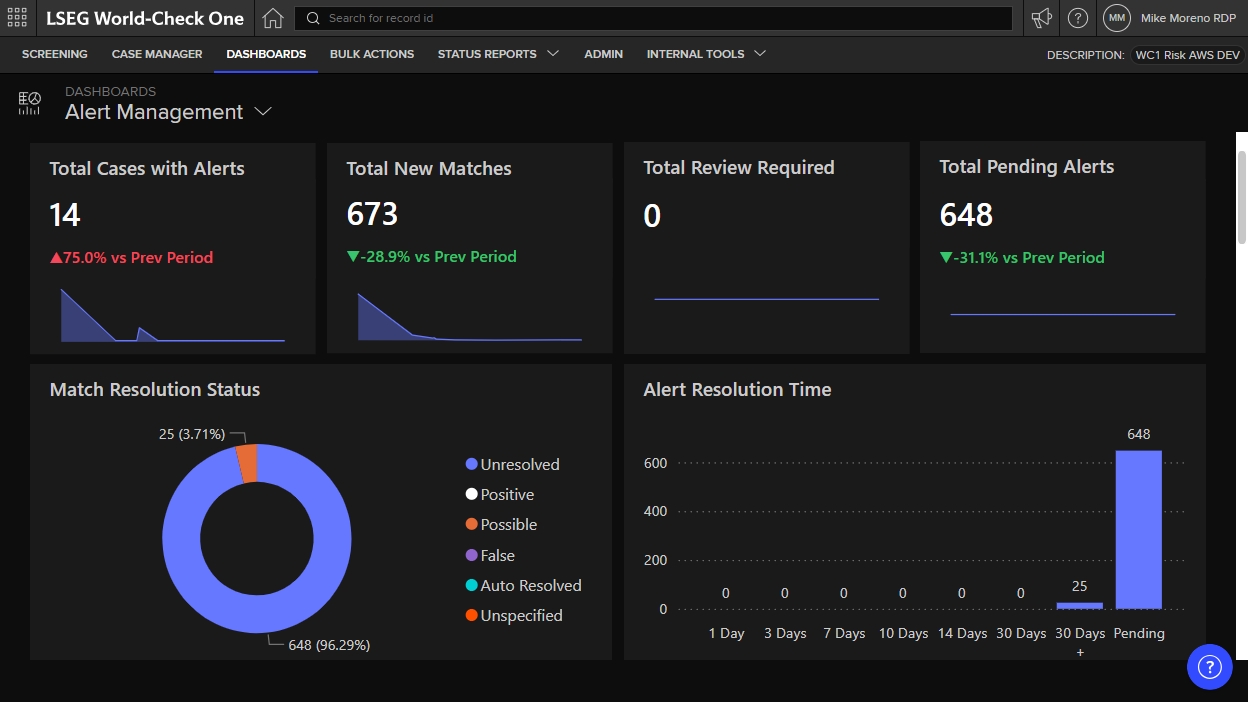

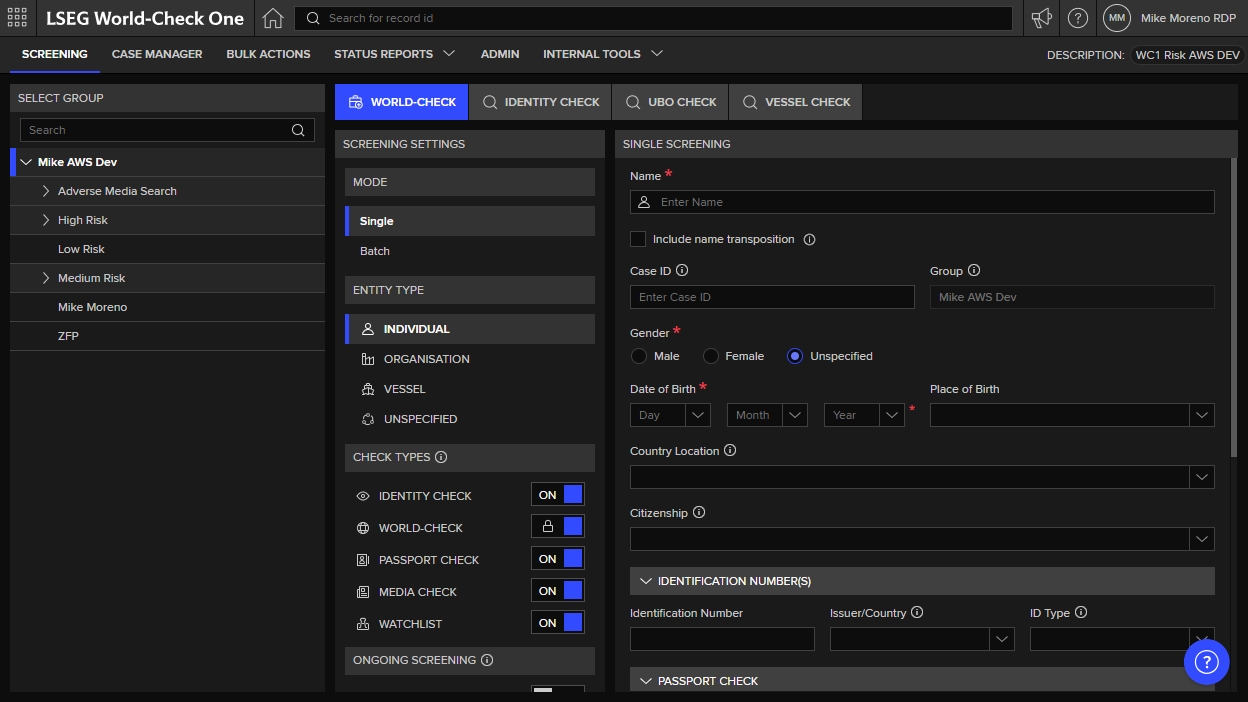

Explore comprehensive screening tools and batch screening capabilities to identify high-risk individuals and PEPs. Identity verification solutions help uncover the Ultimate Beneficial Owner (UBO) and mitigate further business and hidden risks. Continuous monitoring provides valuable insights into AML trends, enabling legal professionals to enhance their risk assessment strategies and stay compliant.

Access World-Check One’s industry-leading database for comprehensive client screenings and quickly identify suspicious activity. This proactive approach allows you to address issues before they impact your business. A solution that grows with your growing business, World-Check One helps you gain a holistic view of your clients’ risk profiles and make informed decisions.

World-Check One helps you stay compliant by adopting a risk-based approach to your law firms KYC and AML so you can dedicate resources more efficiently and fulfil your anti-money laundering and counter-terrorist financial obligations

Our packages

Find the perfect fit or tailor your solution. Explore our range of World-Check One packages to meet your law firm’s unique AML and KYC requirements. Should you require assistance with your purchase, please reach out to one of our specialists.

Product in action

See World-Check One in action

Streamlined screening

Streamline processes such as integrating large volumes of information and advanced functionalities into existing workflows and internal systems with our API.

Secondary matching

Reduce false positives to a minimum with multiple secondary identifiers in World-Check, combined with configurable name matching algorithms and filtering technology.

Integrated workflow

Perform Due Diligence check and Ongoing Screening from within your Opportunity or Contact list within Salesforce, escalate high profiles matches to senior analyst, keep track of risk remediation and compliance review all in one place.

Ongoing monitoring

The powerful combination of World-Check One capabilities enables you to simplify screening for money laundering, sanctions and threat finance; monitor PEP relationships and networks; identify third-party risks; configure ongoing monitoring and more.

Is your legal practice secure?

KYC (Know Your Customer) is an essential part of verifying a client’s identity and assessing potential risks associated with them. By conducting thorough KYC and AML checks for solicitors and lawyers/law firms, they can protect themselves from becoming unintentional accomplices to money laundering, fraud and other illicit activities.

Moreover, staying ahead of compliance is critical. Measures around anti-money laundering for solicitors reduces the risk of being unwittingly involved in financial crimes. According to FATF, potentials risks in the legal industry include:

Client accounts misuse

Creation and management of trusts and companies

Creation and management of charities

Management of client affairs

Purchase of property

Undertaking specific litigation

Not adopting a risk-based approach early on can affect the legal industry in many ways

- Law firms without a risk-based solution can become easy targets for criminals and might miss crucial indicators of money laundering.

- Failure to comply with FATF guidelines can invite regulatory investigations and reputational damage.

- Failure to identify and report suspicious activity can incur legal and financial liability.

- Blocked implementation of preventative measures that address potential vulnerabilities before they arise.

- Inefficient client-onboarding that lacks tailored solutions and ongoing monitoring.

Simplifying KYC and AML for law firms with a risk-based approach

- Given the diversity in scale and activities, some legal professions may be more vulnerable to being exploited for money laundering (ML) and terrorist financing (TF) than others.

- This guidance highlights the need for a sound assessment of the ML/TF risks that legal professionals face so that the policies, procedures and initial and ongoing client due diligence (CDD) measures can mitigate these risks. This risk-based approach (RBA) is central to the EU anti money laundering directive (AMLD) to fight money laundering and terrorist financing.

Source: Guidance for a Risk-Based Approach Guidance for Legal Professionals (fatf-gafi.org)

Frequently Asked Questions (FAQs)

Data File

Integrate World-Check data into third-party or proprietary workflow solutions that perform customer due diligence, customer screening, and/or payments screening.

API

Integrate our data, matching capabilities, and advanced functionalities into existing workflows and internal systems – streamlining the screening process for onboarding, Know Your Customer (KYC), and third-party risk due diligence.

Zero Footprint screening

Benefit from the ability to switch off system tracking, ongoing screening, batch upload, and audit trail functions during screening to ensure no permanent record is kept

Testimonials

What our customers say about us

We partner with LSEG Risk Intelligence to support our market leading compliance program. Integrating World-Check, a respected industry solution in both tradfi and Web3, keeps us at the compliance forefront and positioned for business success.

BitMex

LSEG World-Check’s advanced screening tools help to safeguard our business and ensure a responsible gaming environment for our guests and the community. It's an essential tool that helps us to maintain the highest standards of compliance across our industry.

Crown Resorts

Data and technology are at the core of our services and LSEG World-Check plays a key role in helping our teams to comply with regulation and with our high standards of governance.

CAMS - Computer Age Management Services Ltd

Awards

Check out some of our awards

Chartis Financial Crime and Compliance 50 (FCC50)

Financial Crime Data Management 2024

Partnership Ecosystems 2024

Chartis Research Market Quadrants Report

Name and Transaction Screening Solutions category leader 2024

Adverse Media Monitoring Solutions category leader 2024

RegTech Insight Awards Europe

Best Solution for Sanctions Management 2023

Best Solution for Sanctions Management 2022

Regulation Asia Awards for Excellence

Best PEPs, Sanctions & Name Screening Solution 2023

Best Solutions PEPs, Sanctions & Name Screening 2022

Best AML/CTF Compliance Solution 2019

Best Anti-Money Laundering Solution 2018

RegTech Insight Awards USA

Best KYC Data Solution 2022

Central Banking FinTech RegTech Global Awards

Best Anti-Money Laundering Technology Provider in 2018

Explore more

Relevant products

Request product details

Speak to a specialist

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576