Empowering Financial Research with AI - Unleashing the Power of AIGC

Frank Ling

Jayden Zhang

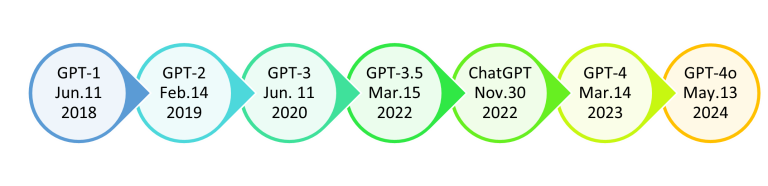

The Rise of AIGC

On November 30, 2022, OpenAI launched ChatGPT, ushering in a new era for AIGC (Artificial Intelligence Generated Content). From v1.0 to v4.0 ChatGPT has progressively advanced language understanding and generation. These advances not only represent a breakthrough in computer science but also a revolution in productivity and AI.

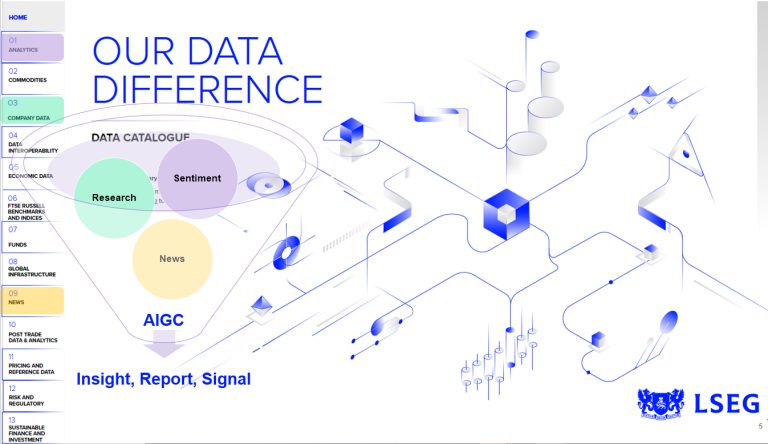

Throughout this evolution, data has become increasingly crucial, and its value redefined within the financial industry. As a leading data provider LSEG offers solutions to enhance the efficiency of financial information and data processing.

To solve for industry needs LSEG has increasingly applied large language models (LLMs) to improve data retrieval efficiency, protect customer data, and assist with decision-making. Retrieval-augmented generation (RAG) has been a more recent focus to rapidly integrate data sources and generate output in dynamic fashion.

What follows are five specific use cases where LSEG is applying AIGC to augment and transform investment research workflows.

Workflow 1: Investment Research Assistant

Harnessing advances in AIGC LSEG has developed an investment research assistant to aid market practitioners in industry research and trading. Investment professionals often need to sift through vast amounts of news and reports to understand the drivers behind asset price changes. This effort is immensely time-consuming.

LSEG’s approach is to drastically improve the efficiency of the required data retrieval and analysis. Utilizing an LLM, along with a user-friendly interface, users can simply type a question and receive an answer, along with the original source(s) used for reference.

Key Advantages

1. High-Quality Data: Top-tier datasets from across LSEG, including, pricing, company conference call minutes, research reports, company filings, and Reuters news.

2. Verifiable Output: Each result is accompanied by its source information allowing for easy verification.

3. Multi-Language and Multi-Asset Class Support: The assistant can answer questions in multiple languages and retrieve data across various regions and asset classes, providing a more comprehensive response.

4. Flexible Deployment: Both cloud services and on-premises deployment options can meet use case requirements.

Workflow 2: Investment Analysis and Advisory

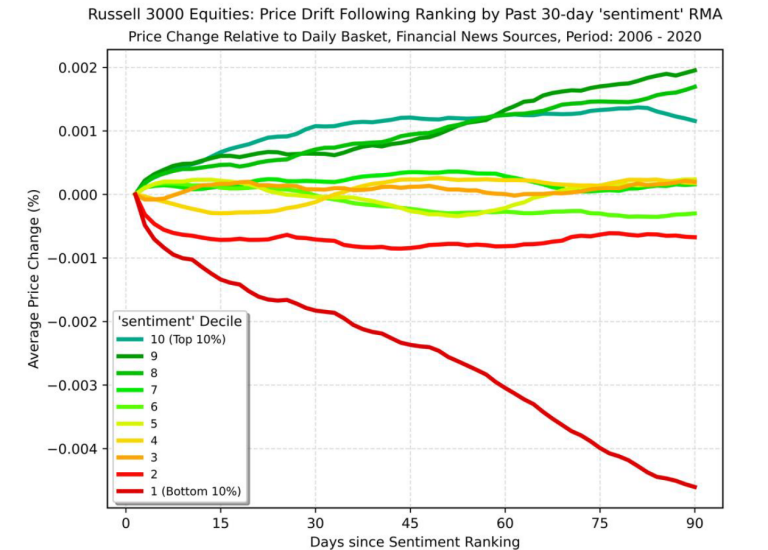

To meet the needs of I&A AIGC has been tapped to integrate quantitative factors with textual data to assist investment advisors in screening targets and generating recommendations. The resulting solution continuously monitors markets and automatically presents new trading ideas and risk warnings.

This approach feeds a selection of stocks based on market sentiment analytics and back testing. The method indicates that stocks with positive sentiment, yield higher returns, validating the effectiveness of sentiment as a factor. In concert, Starmine factors and fundamental factors demonstrate strong overall performance across markets. The process is fine tuned to align with the specific assets in scope.

Workflow 3: Risk Monitoring

Applying AIGC to augment risk monitoring involves daily snapshots, along with real-time notifications and context.

1. Morning Report: A report checks crucial information related to overnight positions, ensuring that any significant developments are promptly highlighted.

2. Real-Time Alerts: During day trading, timely alerts on important price changes and potential drivers are generated.

Price changes in assets are analyzed through both ex-ante and ex-post predictions. Ex-ante forecasting leverages experience to offering timely warnings and identify critical information such as M&A. Ex-post forecasting uncovers information that explains the drivers behind price changes.

Risk monitoring can seamlessly be integrated with an investment research assistant, enabling users to both monitor the market in real-time as well as conduct thorough investigations and research.

Workflow 4: Text Tagging

Applying tagging to companies, assets, individuals, and entities unlocks potential for greater systematic insight generation, but it can also be messy and labor intensive. Training an ML model for text tagging also requires effort. However, with the advent of LLMs, the barriers to entry are much lower. LLMs can now be harnessed to mine data without the need for extensive pre-training. Even with a limited corpus, the recognition capabilities of these large models remain highly effective.

LSEG’s focus is on delivering high-quality input data with full source attribution. This methodology prioritizes delivering accurate and reliable results while yielding the best utility of LLMs across tagging workflows.

Workflow 5: At A Glance

Traders need to identify the most significant potential trades of the day. LSEG transforms text data into a machine-readable form, which is then analyzed and summarized by a large model. This helps users quickly see "at a glance" the latest research reports and market views of target assets, facilitating informed decision-making.

While traditional techniques parse PDF text, they often miss critical information. LSEG’s machine-readable news and research report API utilize a proprietary model to ensure text information accuracy.

Summary

The effectiveness of AIGC solutions heavily rely on high-quality unstructured input data. LSEG is at the forefront of enabling and delivering data to meet these growing demands.

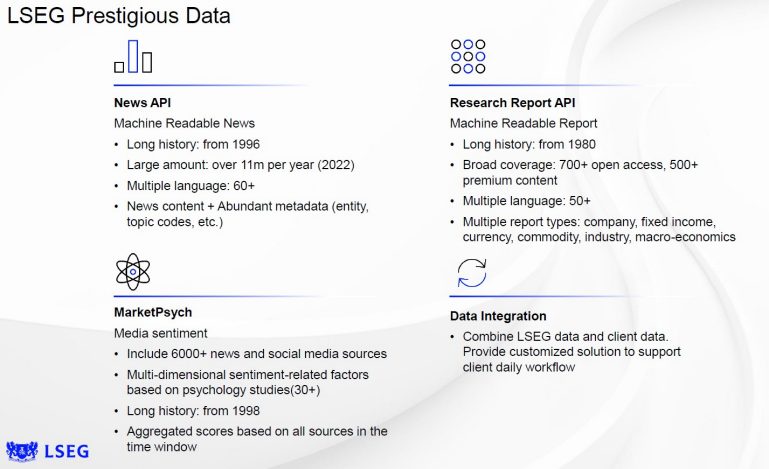

Solutions such as machine-readable news (MRN) enable LSEG to perform analysis using both large and traditional models. This news feed from Reuters is exclusive, with historical machine-readable news dating back to 1996, growing by 11 million articles each year across multiple languages.

In addition, machine-readable research reports cover a broad spectrum of brokerages and asset classes, including corporates, fixed income, currency, commodities, sectors, macro, ESG, quants, derivatives, and other topics.

Sentiment Factor, in exclusive partnership with MarketPsych, provides unique sentiment analytics across multiple asset classes globally. Sentiment analysis on transcript text is on the way as well.

Across the industry and market, it’s an exciting time to discover and benefit from the advances in data and technology. In this era of LLMs we look forward to the further advances brought by AIGC to financial investment and research, with a close eye on unstructured text data.