Shrey Kohli

Jinan Al Taitoon

The ESG sukuk market is growing fast. In 2024, issuance of ESG sukuk grew by 14% year-on-year, to $15.2 billion.[1] Over that period, it represented 1.8% of total ESG bond issuance, and 6.1% of total sukuk issuance.[2]

ESG debt, however, now makes up almost 7.5% of total debt finance raised.[3] This represents an opportunity for sustainable sukuk.

Crucial to seizing this opportunity is guidance published in collaboration with the Islamic Development Bank, the International Capital Market Association and LSEG in April 2024. It includes practical information for issuers and market participants on how sukuk can be labelled as green, social or sustainable. Greater understanding of the key concepts involved can help drive strong growth in ESG sukuk.

Sukuk explained

Islamic finance refers to financial activity that is carried out in accordance with Islamic law, or Shariah. One of the principles of Islamic finance is that returns from financial instruments are linked to income or profits from real economic activity.

One of its key characteristics is a prohibition on the collection of interest by lenders. To address this, Islamic financiers have developed sukuk, financial instruments that generate returns from an underlying portfolio of assets, which generate returns similar to those of conventional fixed-income products, such as bonds. They typically ensure Shariah-compliance by granting the holder a nominal ownership share in the underlying asset pool, without recourse to the assets, much like a senior unsecured bond. Sukuk issuers are also required to demonstrate that the issuance complies with the principles of Shariah. This usually requires a Shariah board, made up of Islamic scholars, to certify that the underlying assets are Shariah-compliant.

Islamic finance continues to show strong growth. In 2024, issuers raised $250 billion through sukuk, an increase of 16% compared with 2023. This is a reflection of the growing integration of Islamic economies into global capital markets, and a desire among key Islamic sovereign issuers to diversify their economies, and for banks and companies to participate in that transformation and access new sources of funding.

Sukuk historical issuance 2020 – 2024

In absolute terms, ESG sukuk is growing fast, albeit from a low base. In 2020, issuers sold $4.8 billion of ESG sukuk.[4] In 2024, that figure had risen to $15.2 billion. There is potential for further growth as the ESG sukuk market catches up with its conventional peer, especially given the growing interest by Islamic world countries in funding climate action and progress towards the UN Sustainable Development Goals.

ESG Sukuk historical issuance 2020 – 2024

So, what will it take to unlock more supply?

It is key to increase familiarity of sukuk among investors and non-Islamic issuers, and to address the perceived complexity of ESG sukuk among existing sukuk issuers.

To help achieve this, a number of stakeholders – including the Islamic Development Bank, the UK and Indonesian governments, and LSEG – came together at COP26 in 2021 to launch the High-Level Working Group on Green and Sustainability Sukuk.

One of the goals of the Working Group was to produce guidance to give issuers and investors direction on how to label sukuk as green, social or sustainability. That guidance was published in April 2024 as a collaboration between three key actors within the industry – the Islamic Development Bank, an AAA-rated supranational owned by 57 member countries of the Organization of Islamic Cooperation and one of the largest issuers of sukuk; the International Capital Market Association (ICMA), the steward for the global Principles governing green and sustainable debt; and LSEG, one of the world’s leading financial market infrastructure providers – and through the London Stock Exchange, one of the largest markets for sukuk globally.

A key observation in the guidance is that there are strong synergies between Islamic finance and sustainable finance. For example, both promote sustainable development, financial inclusion and environmental stewardship. Both often exclude activities that can lead to social impacts which some perceive as negative – such as alcohol, gambling and weapons and both offer potential resilience to financial crisis, by avoiding speculative instruments and instead offering strong linkages to the real economy. Another key observation is that all eligible projects categories within the Green and Social Bond Principles are consistent with Shari’ah principles. Sustainable sukuk with a theme, such as “transition” sukuk, “blue” sukuk or “gender” sukuk can also be issued in line with the ICMA Climate Transition Finance Handbook and specific guidance on blue finance from “Bonds to Finance the Sustainable Blue Economy: A Practitioner’s Guide” and “Bonds to Bridge the Gender Gap: A Practitioner’s Guide to Using Sustainable Debt for Gender Equality” respectively.

Steps for issuers

The guidance provides useful information for potential issuers of ESG sukuk. It explains the types of projects that are likely to be eligible, and the steps that issuers need to take to issue ESG sukuk instruments.

These steps will vary, depending on whether the issuer is already active in the conventional bond market, in the ESG bond market, or in the sukuk market. For example, issuers of non-Shari’ah bonds would need to assess whether they have sufficient Shari’ah-compliant assets to underpin an issue, while existing sukuk issuers would need to create a sustainable finance framework to ensure that the projects they fund from sustainable sukuk are aligned with ICMA’s Green or Social Bond Principles.

Steps for investors

For investors, meanwhile, ESG sukuk offer potential exposure to new issuers, often from countries that are under-represented within ESG debt portfolios. ESG sukuk issuance to date is predominantly from similar sectors as the conventional ESG debt market, such as sovereigns, banks and utilities, although we are now also seeing issuance from sectors such as real estate and logistics.

Bright prospects for sustainable sukuk

Significant sovereign and corporate issuers are already tapping the sustainable sukuk market. In 2024, Indonesia came to market with $3.3 billion of issuance as part of its ongoing green sukuk programme. Corporate issuers included Malaysia Rail Link and Aldar Investment Properties and bank issuers included Dubai Islamic bank and Al Rajhi Bank.

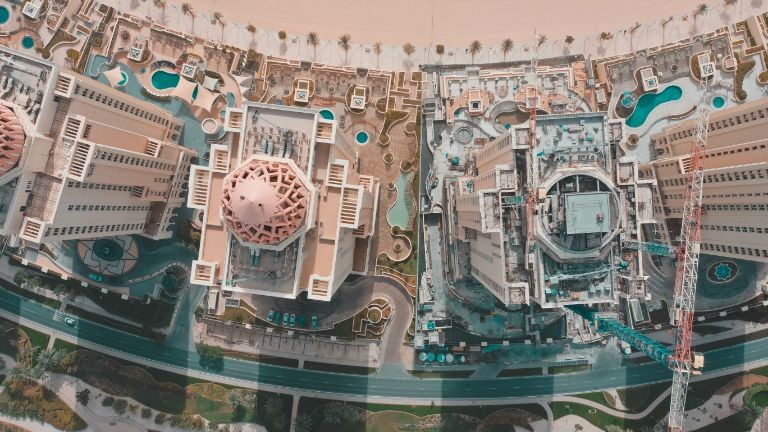

The London Stock Exchange, an LSEG business, has been the venue of choice for much of this issuance. The exchange is a leader in the conventional sukuk market, with around $95 billion in sukuk issuance from 2020.[5] ESG sukuk listings in London include debut issuances from Qatar International Islamic Bank (QIIB), raising $500 million, a $500 million issuance for Kuwait’s Warba Bank, and $750 million from the Saudi Investment Bank.

There is also potential for non-Islamic world companies to enter the ESG sukuk market. In the traditional bond market, we have seen a handful of non-Islamic world issuers sell sukuk. For example, two US aircraft leasing firms, which count Islamic world airlines as some of their largest customers, have looked to align their investor base with that of their customers.

In conclusion, we see a congruence of factors – e.g. growth within the Islamic world, fiscal imperatives, the need for climate and Sustainable Development Goal (SDG) financing, greater capital markets integration, and deeper capital markets familiarity – that are set to drive strong growth in sustainable sukuk over the coming years.

LSEG stands ready to support the market’s continued growth.

[1] LSEG Islamic Finance Research, Jan 2025

[2] LSEG Workspace

[3] LSEG Islamic Finance Research, Jan 2025

[4] LSEG Workspace

[5] LSEG Workspace, Jan 2025

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2024 London Stock Exchange Group. All rights reserved.