Sustainable Finance

Sustainable Finance Regulation

With the growing shift towards sustainable investing, new regulation means navigating the sustainable landscape can be challenging.

Discover more about what the European Commission's Omnibus proposals mean for investors and issuers

Multiple pressures, including investor, societal and environmental, have resulted in increased numerous sustainable finance regulation affecting corporates to fund managers.

Greater regulation allows market participants to navigate the investment landscapes more safely, encourages standardisation across the market and ensure relevant disclosure is available. In turn this enables investors to make an active choice to invest sustainably and play their part in supporting the development of a more sustainable economy.

To reach the Paris Agreement and reduce the impacts of climate change, a range of regulatory efforts have been put in place to positively impact the market that we serve.

How we help

Helping you navigate sustainable regulation

EU Taxonomy

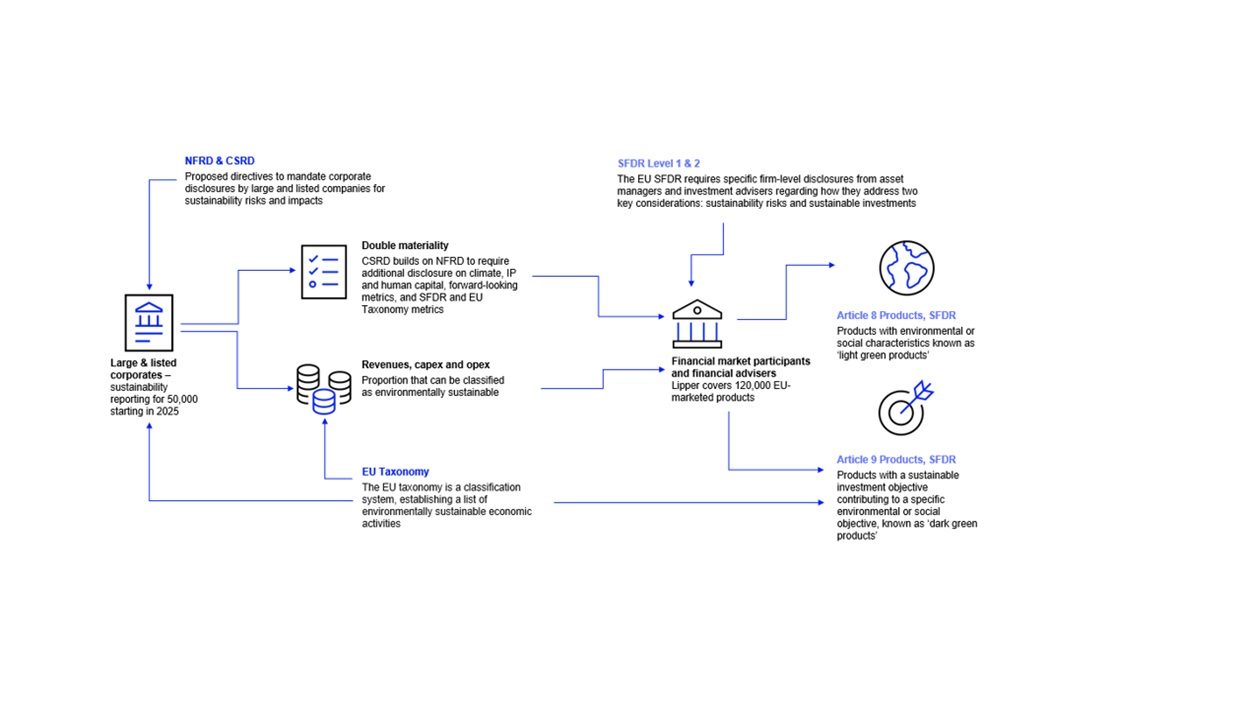

The EU taxonomy is a classification tool to help investors and companies consistently determine whether an economic activity is environmentally sustainable or not. It provides specific, quantitative thresholds on environmental performance for economic activities to be considered compliant with the EU taxonomy allowing market participants to navigate the transition to a low-carbon economy.

The EU taxonomy for sustainable activities is based around six environmental objectives:

1. Climate change mitigation

2. Climate change adaption

3. Sustainable use and protection of water and marine resources

4. Transition to a circular economy, waste prevention and recycling

5. Pollution prevention and control

6. Protection of healthy ecosystems

The LSEG EU Taxonomy data solution allows market participants to identify and report on the proportion of their portfolios which are eligible or aligned to EU taxonomy objectives. The data can help identify exposure to climate transition risks and identify opportunities for investment in companies undertaking green activities.

Discover more about LSEG’s EU Taxonomy solutions and LSEG Lipper’s coverage of European ESG related fund disclosures required by the EU Taxonomy.

Learn more about how LSEG partnerships can help market participants meet EU Taxonomy standards.

Discover more about our EU Taxonomy data solution methodology.

Data used in the LSEG EU Taxonomy Data Solution

LSEG EU Taxonomy data in action

CSRD

The EU Corporate Sustainability Reporting Directive (CSRD) is a European Union directive aimed at enhancing and standardizing the sustainability reporting of companies across the EU and beyond. It requires large companies (public and private) and all listed small and medium-sized enterprises (SMEs) on regulated markets, to disclose comprehensive information on their ESG impacts by incorporating the so-called Double Materiality Assessment (DMA).

As we look towards 2025, at LSEG we are accelerating the expansion of our data solutions and processes to enable companies to better understand the data and help companies to comply with the regulation.

SFDR

The Sustainable Finance Disclosure Regulation (SFDR) introduces disclosure standards for financial market participants, advisors and products.

The aim of the regulation is to minimise greenwashing and to provide a transparent view into sustainability investments for the end investor. To meet the SFDR, asset managers need accurate and trusted data. This is where LSEG can help.

LSEG has a solid coverage across SFDR related metrics which fuel our solutions both via desktop and feed, including full coverage of SFDR level 1 data for funds registered for sale in Europe which is being expanded to incorporate all new SFDR level 2 data.

Find out more about

SDFR template in Portfolio Analytics app

TCFD

The Task Force on Climate-Related Financial Disclosures (TCFD) provides recommendations for more effective climate-related disclosures that promote more informed investment, credit and insurance underwriting decisions.

The TCFD enables stakeholders to understand carbon-related assets and exposure to carbon-related risks.

TCFD disclosure recommendations are structured around four core elements that investors expressed interest in and represent how organisation operate:

- Governance

- Strategy

- Risk Management

- Metrics and targets

At LSEG, we have mapped our climate-related data to ensure our methodologies and data measures are aligned to the TCFD recommendations.

Discover more about LSEG’s ESG Reporting Solutions, a user friendly data collection and automated emissions calculation system for corporates.

MiFID and IDD (Insurance Distribution Directive)

Fund overview in LSEG Workspace, displaying key attributes featured in the European ESG Template

Both MiFID and IDD have added the requirement that recommendations to customers and potential customers should reflect both the financial objectives and any sustainability preferences expressed by those customers.

The aim is to ensure investors can invest and save sustainably and to facilitate their participation in the transition to a low carbon, more sustainable, resource efficient economy.

For funds, LSEG is expanding its coverage of SFDR level 1 data to incorporate all the new ESG and sustainability disclosures required to comply with MiFID and IDD. This will enable customers to screen for suitable fund products, and to confirm the sustainability of each fund.

Discover more about LSEG Lipper’s coverage of European ESG related fund disclosure required by MiFID and IDD regulations.

Request details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576